GST Deferral Process

Below is a program introduced by the federal government on March 27, 2020, as part of the so-called COVID-19 relief program. I have outlined my experience trying to take advantage of this program and have had similar experiences with all of the other government programs that are supposed to help relieve stress for businesses during these difficult times.

Deferral of Sales Tax Remittance and Customs Duty Payments

In order to provide support for Canadian businesses during these unprecedented economic times, the Government is deferring Goods and Services Tax/Harmonized Sales Tax (GST/HST) remittances and customs duty payments to June 30, 2020.

This measure could provide up to $30 billion in cash flow or liquidity assistance for Canadian businesses and self-employed individuals over the next three months

GST/HST Remittance Deferral

The GST/HST applies to sales of most goods and services in Canada and at each stage of the supply chain. Vendors must collect the GST/HST and remit it (net of input tax credits) with their GST/HST return for each reporting period.

Vendors with annual sales of more than $6 million remit and report monthly, and those with annual sales of $1.5 million to $6 million are able to remit and report on a quarterly basis (or monthly if they choose to). Small vendors can report annually.

The GST/HST amounts collected are generally due by the end of the month following the vendor’s reporting period: e.g., for a monthly filer, the GST/HST amounts collected on its February sales are due by the end of March.

To support Canadian businesses in the current extraordinary circumstances, the Minister of National Revenue will extend until June 30, 2020 the time that:

Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods

Quarterly filers have to remit amounts collected for January 1, 2020 through March 31, 2020 reporting period; and

Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

I own a small business headquartered in Calgary, Alberta called InOrbis. We are a city-to-city transportation company and when virtually all businesses cancelled their travel plans our sales and financial position was severely impacted. InOrbis pays GST Quarterly and was going to pay $4028.84 on March 31, 2020, as part of a pre-authorized debit agreement with the CRA through our business account.

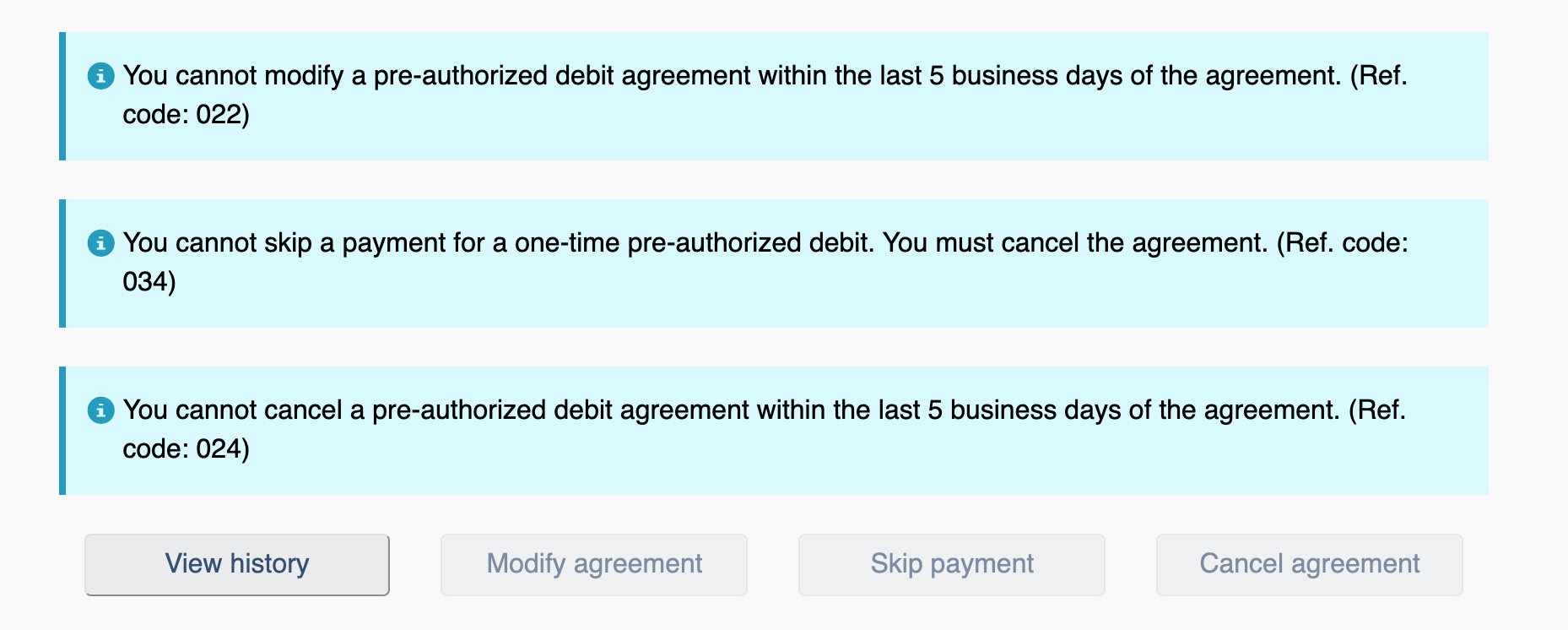

As soon as this program was was announced I felt excited because we would have the opportunity to keep paying some of our staff for a few more weeks thanks to the deferral. I logged on to our CRA My Business Account and went to cancel our pre-authorized debit and saw this message.

Because the announcement was made by the government only 4 days before the payment deadline (March 31) there would be no way for us to cancel the payment online.

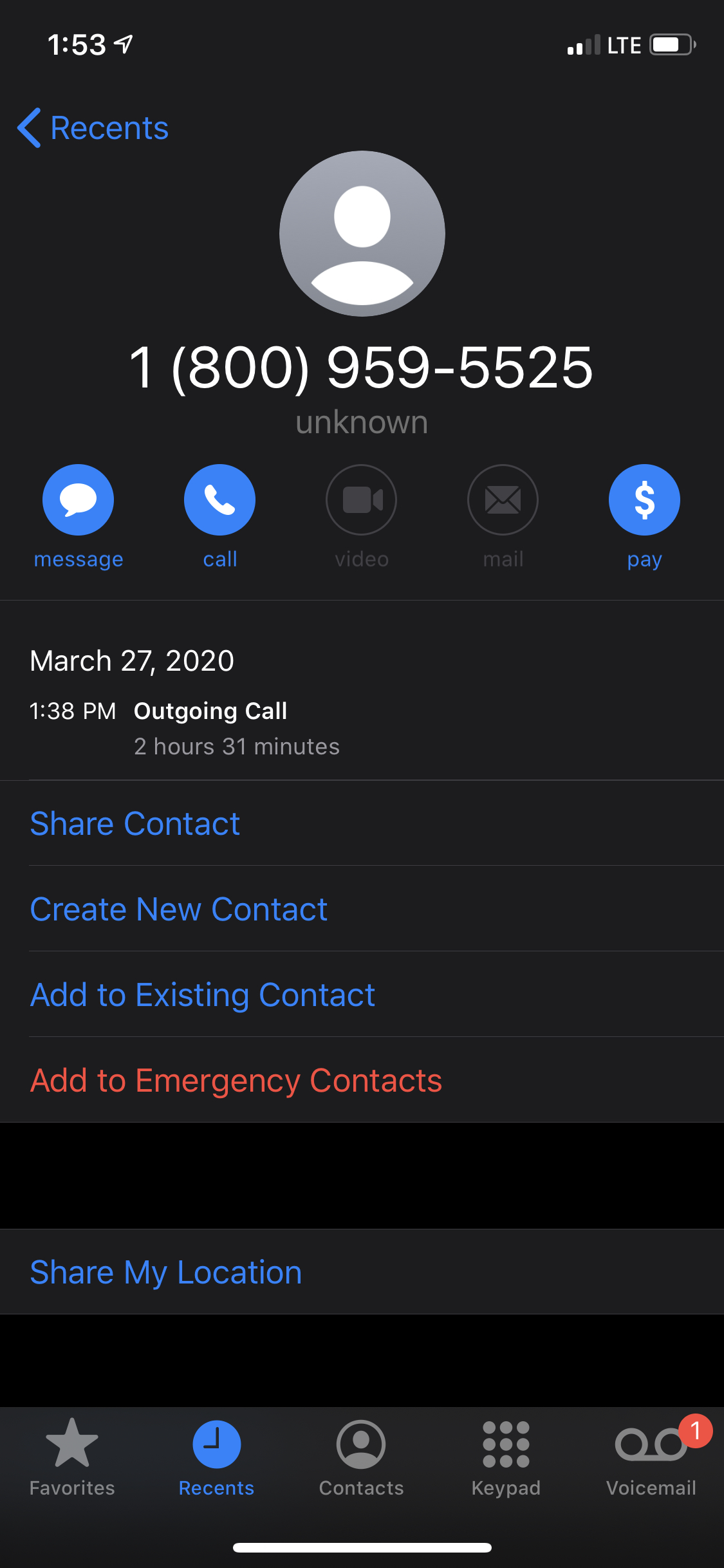

I then attempted to call CRA through their phone line at 1-800-959-5525. For my first call, made at 1:38 PM on Friday March 27 (only a few minutes after the announcement) I was on hold for 2 hours and 31 minutes before the call disconnected. After calling back the line was busy and disconnected automatically. Finally, at 6:30 PM, a call connected and I was informed by a robot voice that the office was closed and I would have to call back on Monday.

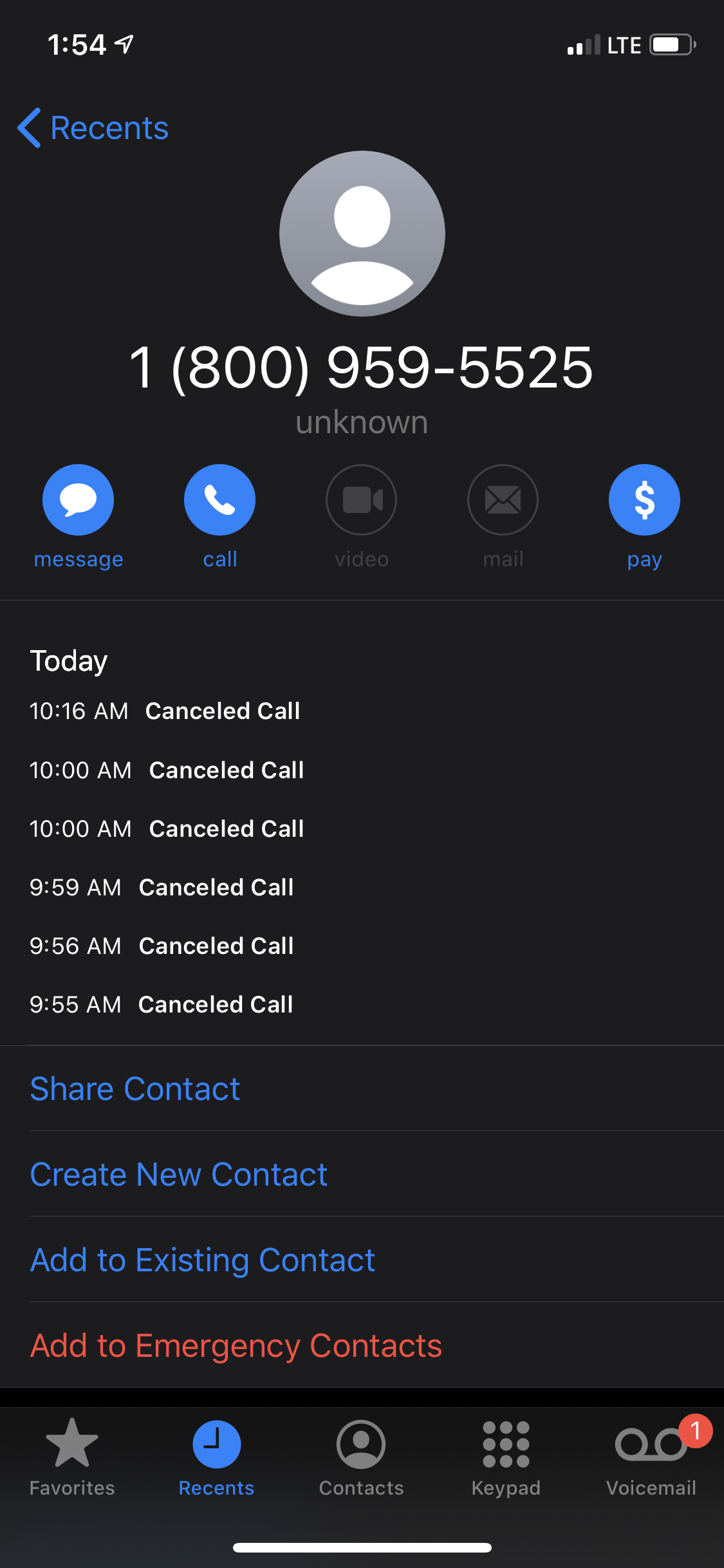

On Monday, March 30, 2020 I called again from my phone several times but the call would not go through (Call Failed).

Finally, I asked my girlfriend to try calling as well through her phone. She was able to get on hold. After waiting for over 1 and a half hours (see call log below) someone answered. Very rudely, this person, a woman, asked what I wanted. Obviously I do not fault her directly, she is probably dealing with the same stressors as the rest of us. I told her that we had a Pre Authorized Debit payment that was scheduled for tomorrow to the Government for GST and that I wanted to cancel it. She then told me that it would require 10 business days’ notice. Yes. 10 business days. 5 days longer than what was listed on the website. I asked her what I could do and she offered no options. I then asked her if I would be charged a fee from the government if the payment from the bank bounced, she did not know. I told her I would try calling my bank. Without saying goodbye she hung up.

As an aside: There must be a majority of businesses that have a pre-authorized payments scheduled for March 31 as it is the end of Q1 and most small businesses remit GST quarterly, so this cannot possibly only affect me. It seems as though this program (along with several others) are merely an illusion or a fabrication that most businesses could never hope to actually access. It scares me that government could be so obviously disingenuous or incompetent so as not to be able to execute as simple of a function as cancelling a payment.

I am now on hold with my bank (RBC) to try to cancel the payment from their side.

Like many businesses, we are struggling and our sales have completely stopped since lockdowns began over two weeks ago.

Update: After speaking with RBC for several hours, they were unable to help me cancel the payment. Finally, a representative recommended that I try to empty the account and take the hit of a $50 NSF in order to have the payment not come out of the account. I did this, but somehow the payment still came out and I now have a negative balance in the account. I will update you soon.

This entire process has been beyond frustrating. While trying to run my business and keep it moving forward, I am trying to apply for these government programs so that we do not fall behind and lose out on funds that have become available. It seems that the government is creating distractions to pull business owners’ attention away from the fact that they have forced us to shut down because they were unprepared to respond to this pandemic with the equipment and medical supplies and medicine that was needed. Instead of spending $200 Billion on business “relief” programs that no one can access, why not spend it on medical masks, vaccine research, health care workers, and ventilators?