Become a MILLIONAIRE in 16 seconds #Shorts – Applying AI

Become a MILLIONAIRE in 15 seconds #Shorts – Applying AI

RENT VS BUY! Is it better to own your home?!? – Applying AI

What’s better, reting or owning your home? In this video, you’ll learn to decide which option is better for you from a financial perspective.

Trying to Access CRA Business Aid Programs During an Epidemic – Applying AI

GST Deferral Process

Below is a program introduced by the federal government on March 27, 2020, as part of the so-called COVID-19 relief program. I have outlined my experience trying to take advantage of this program and have had similar experiences with all of the other government programs that are supposed to help relieve stress for businesses during these difficult times.

Deferral of Sales Tax Remittance and Customs Duty Payments

In order to provide support for Canadian businesses during these unprecedented economic times, the Government is deferring Goods and Services Tax/Harmonized Sales Tax (GST/HST) remittances and customs duty payments to June 30, 2020.

This measure could provide up to $30 billion in cash flow or liquidity assistance for Canadian businesses and self-employed individuals over the next three months

GST/HST Remittance Deferral

The GST/HST applies to sales of most goods and services in Canada and at each stage of the supply chain. Vendors must collect the GST/HST and remit it (net of input tax credits) with their GST/HST return for each reporting period.

Vendors with annual sales of more than $6 million remit and report monthly, and those with annual sales of $1.5 million to $6 million are able to remit and report on a quarterly basis (or monthly if they choose to). Small vendors can report annually.

The GST/HST amounts collected are generally due by the end of the month following the vendor’s reporting period: e.g., for a monthly filer, the GST/HST amounts collected on its February sales are due by the end of March.

To support Canadian businesses in the current extraordinary circumstances, the Minister of National Revenue will extend until June 30, 2020 the time that:

Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods

Quarterly filers have to remit amounts collected for January 1, 2020 through March 31, 2020 reporting period; and

Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

I own a small business headquartered in Calgary, Alberta called InOrbis. We are a city-to-city transportation company and when virtually all businesses cancelled their travel plans our sales and financial position was severely impacted. InOrbis pays GST Quarterly and was going to pay $4028.84 on March 31, 2020, as part of a pre-authorized debit agreement with the CRA through our business account.

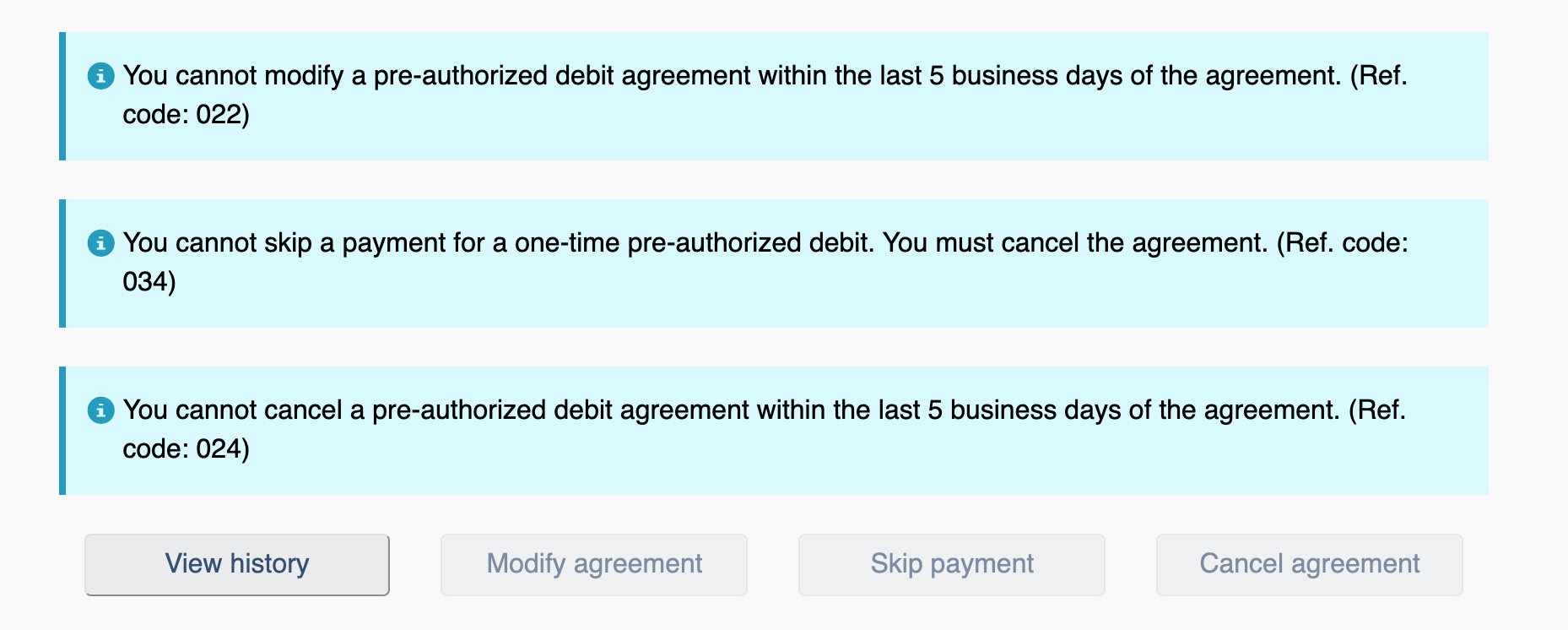

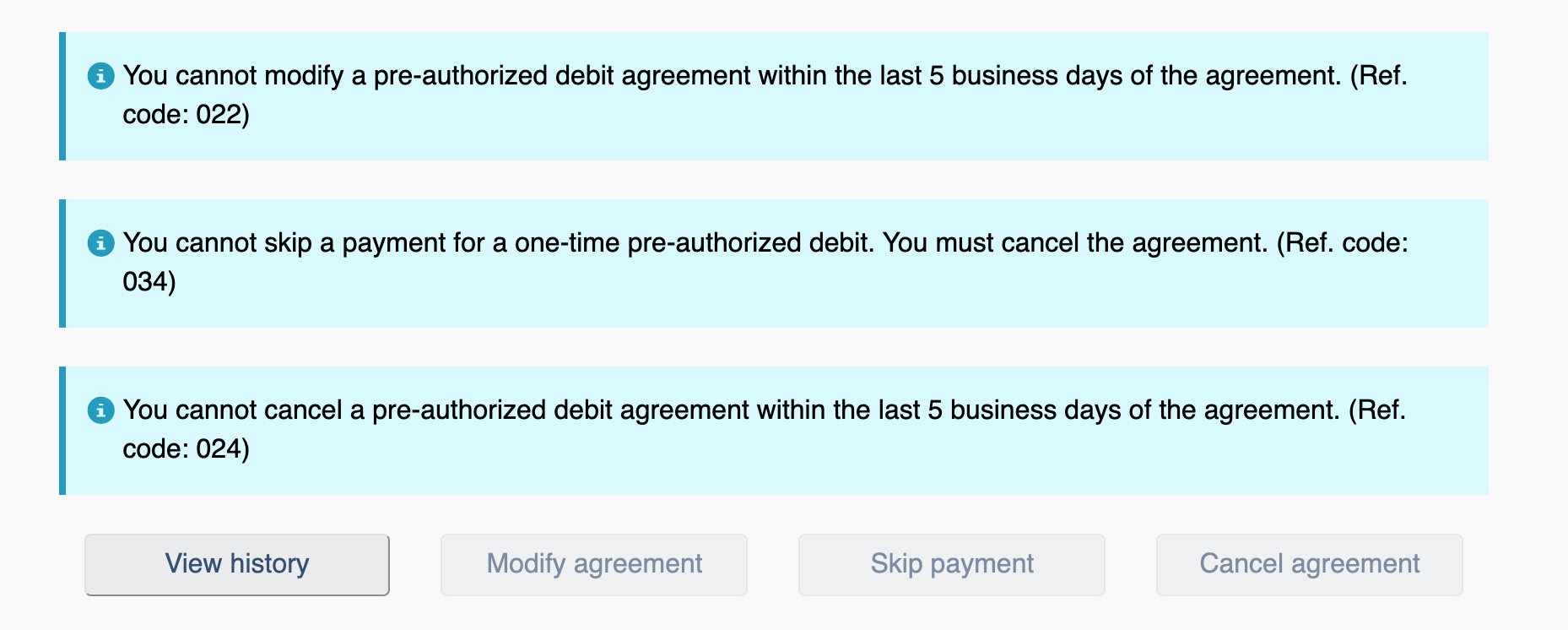

As soon as this program was was announced I felt excited because we would have the opportunity to keep paying some of our staff for a few more weeks thanks to the deferral. I logged on to our CRA My Business Account and went to cancel our pre-authorized debit and saw this message.

Because the announcement was made by the government only 4 days before the payment deadline (March 31) there would be no way for us to cancel the payment online.

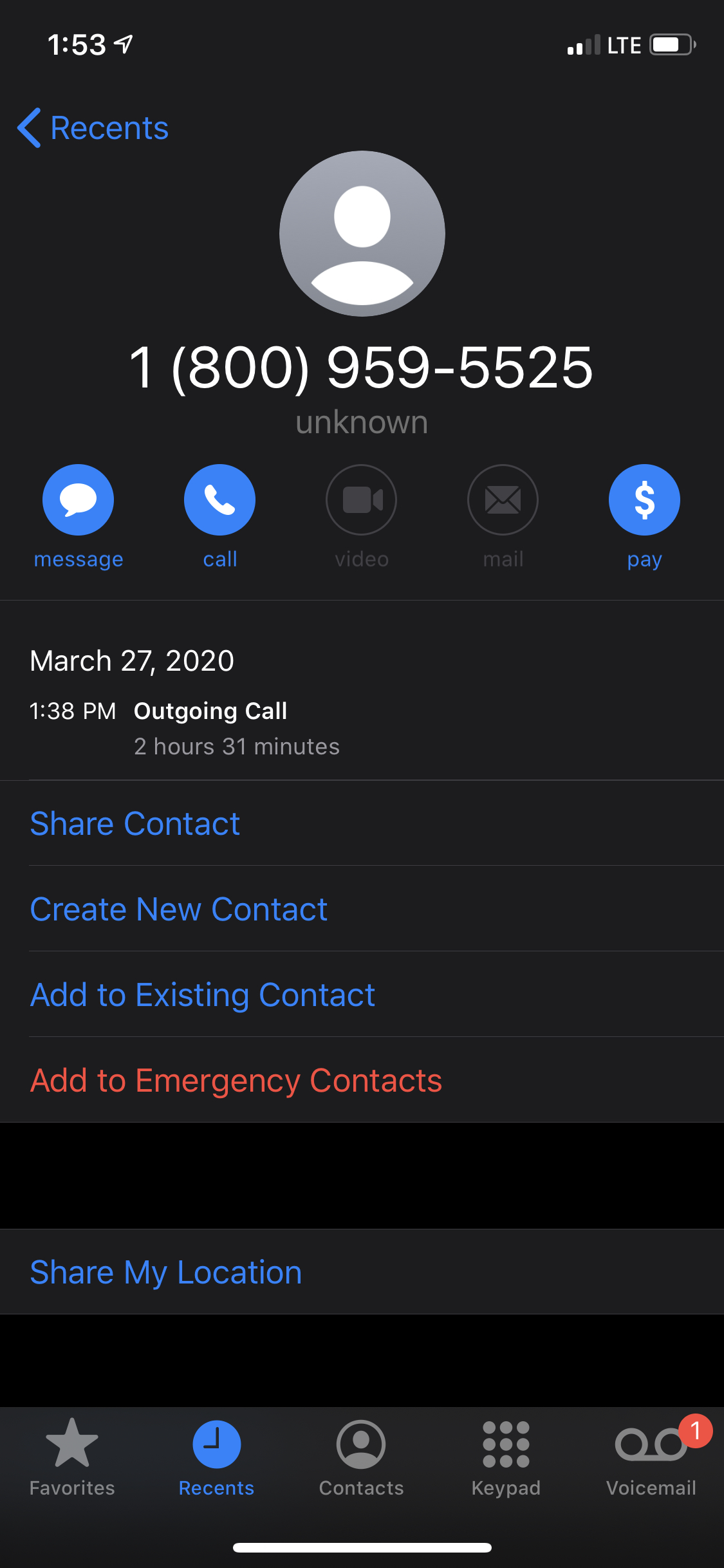

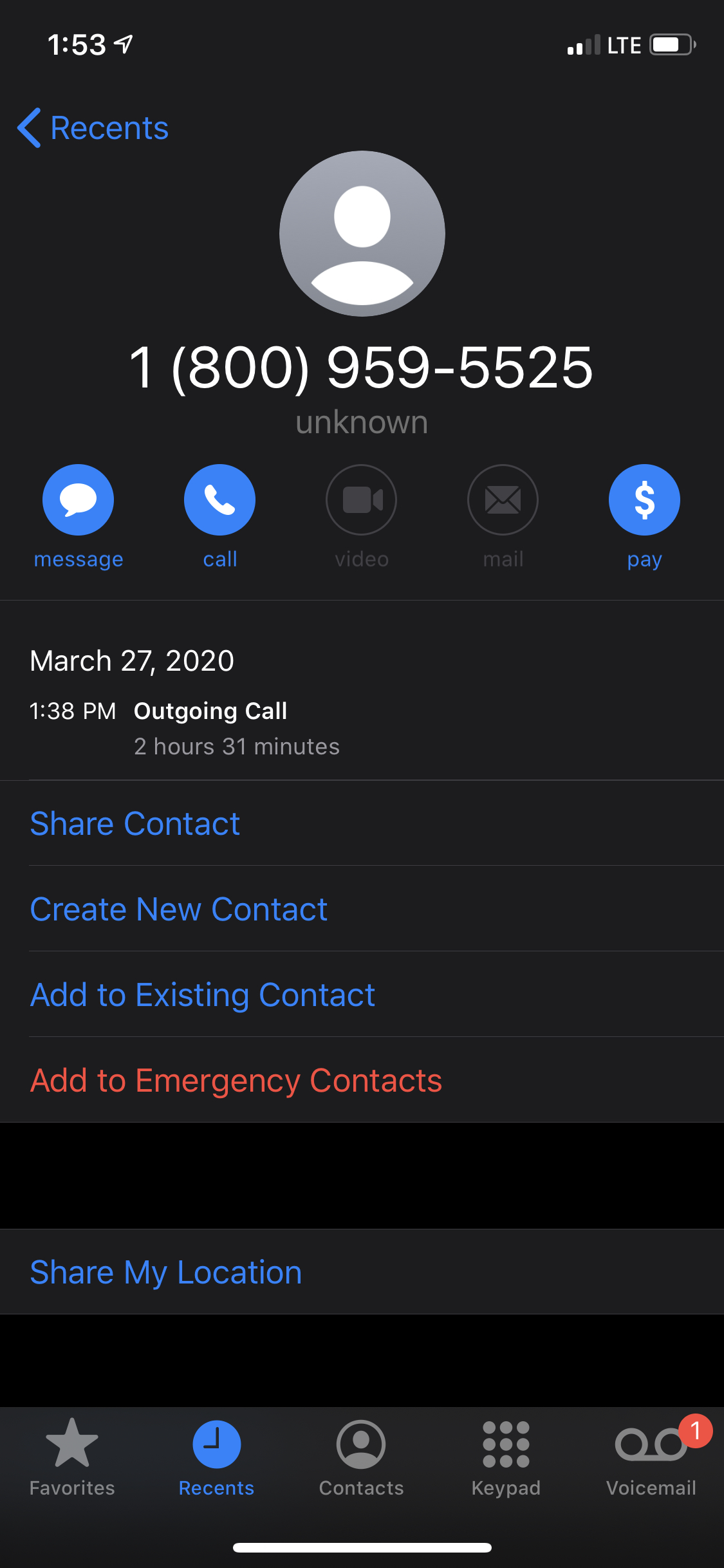

I then attempted to call CRA through their phone line at 1-800-959-5525. For my first call, made at 1:38 PM on Friday March 27 (only a few minutes after the announcement) I was on hold for 2 hours and 31 minutes before the call disconnected. After calling back the line was busy and disconnected automatically. Finally, at 6:30 PM, a call connected and I was informed by a robot voice that the office was closed and I would have to call back on Monday.

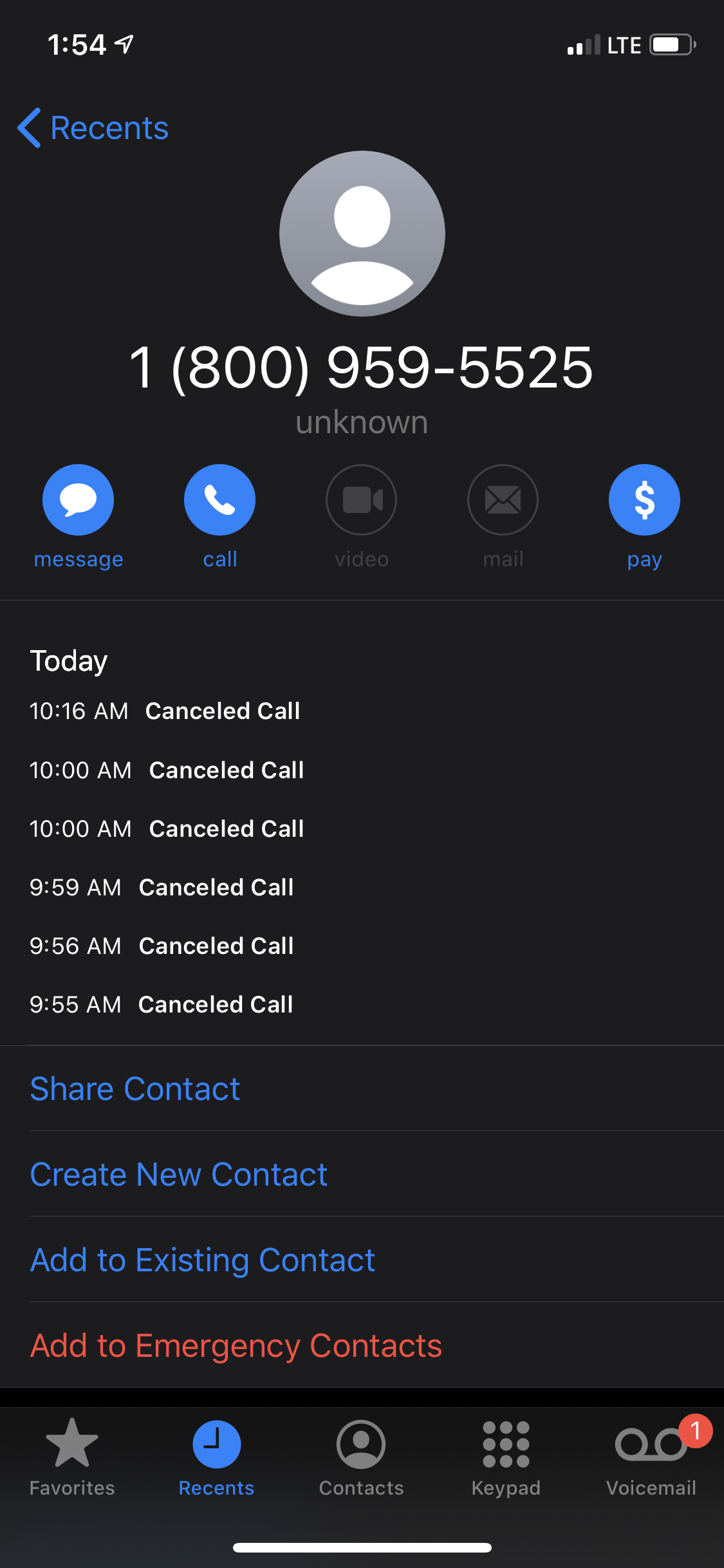

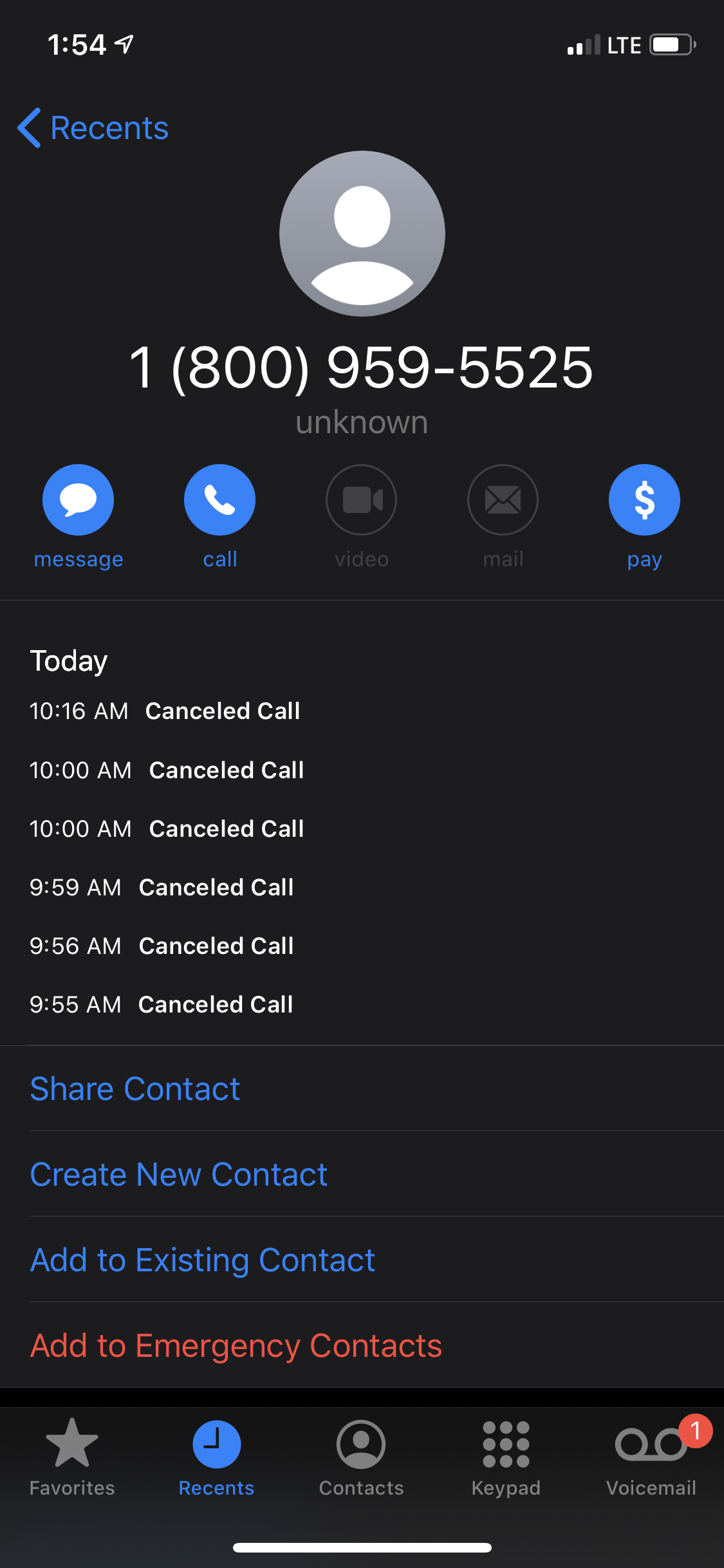

On Monday, March 30, 2020 I called again from my phone several times but the call would not go through (Call Failed).

Finally, I asked my girlfriend to try calling as well through her phone. She was able to get on hold. After waiting for over 1 and a half hours (see call log below) someone answered. Very rudely, this person, a woman, asked what I wanted. Obviously I do not fault her directly, she is probably dealing with the same stressors as the rest of us. I told her that we had a Pre Authorized Debit payment that was scheduled for tomorrow to the Government for GST and that I wanted to cancel it. She then told me that it would require 10 business days’ notice. Yes. 10 business days. 5 days longer than what was listed on the website. I asked her what I could do and she offered no options. I then asked her if I would be charged a fee from the government if the payment from the bank bounced, she did not know. I told her I would try calling my bank. Without saying goodbye she hung up.

As an aside: There must be a majority of businesses that have a pre-authorized payments scheduled for March 31 as it is the end of Q1 and most small businesses remit GST quarterly, so this cannot possibly only affect me. It seems as though this program (along with several others) are merely an illusion or a fabrication that most businesses could never hope to actually access. It scares me that government could be so obviously disingenuous or incompetent so as not to be able to execute as simple of a function as cancelling a payment.

I am now on hold with my bank (RBC) to try to cancel the payment from their side.

Like many businesses, we are struggling and our sales have completely stopped since lockdowns began over two weeks ago.

Update: After speaking with RBC for several hours, they were unable to help me cancel the payment. Finally, a representative recommended that I try to empty the account and take the hit of a $50 NSF in order to have the payment not come out of the account. I did this, but somehow the payment still came out and I now have a negative balance in the account. I will update you soon.

This entire process has been beyond frustrating. While trying to run my business and keep it moving forward, I am trying to apply for these government programs so that we do not fall behind and lose out on funds that have become available. It seems that the government is creating distractions to pull business owners’ attention away from the fact that they have forced us to shut down because they were unprepared to respond to this pandemic with the equipment and medical supplies and medicine that was needed. Instead of spending $200 Billion on business “relief” programs that no one can access, why not spend it on medical masks, vaccine research, health care workers, and ventilators?

April 2020 – Applying AI: Transforming Finance, Investing, and Entrepreneurship

GST Deferral Process

Below is a program introduced by the federal government on March 27, 2020, as part of the so-called COVID-19 relief program. I have outlined my experience trying to take advantage of this program and have had similar experiences with all of the other government programs that are supposed to help relieve stress for businesses during these difficult times.

Deferral of Sales Tax Remittance and Customs Duty Payments

In order to provide support for Canadian businesses during these unprecedented economic times, the Government is deferring Goods and Services Tax/Harmonized Sales Tax (GST/HST) remittances and customs duty payments to June 30, 2020.

This measure could provide up to $30 billion in cash flow or liquidity assistance for Canadian businesses and self-employed individuals over the next three months

GST/HST Remittance Deferral

The GST/HST applies to sales of most goods and services in Canada and at each stage of the supply chain. Vendors must collect the GST/HST and remit it (net of input tax credits) with their GST/HST return for each reporting period.

Vendors with annual sales of more than $6 million remit and report monthly, and those with annual sales of $1.5 million to $6 million are able to remit and report on a quarterly basis (or monthly if they choose to). Small vendors can report annually.

The GST/HST amounts collected are generally due by the end of the month following the vendor’s reporting period: e.g., for a monthly filer, the GST/HST amounts collected on its February sales are due by the end of March.

To support Canadian businesses in the current extraordinary circumstances, the Minister of National Revenue will extend until June 30, 2020 the time that:

Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods

Quarterly filers have to remit amounts collected for January 1, 2020 through March 31, 2020 reporting period; and

Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

I own a small business headquartered in Calgary, Alberta called InOrbis. We are a city-to-city transportation company and when virtually all businesses cancelled their travel plans our sales and financial position was severely impacted. InOrbis pays GST Quarterly and was going to pay $4028.84 on March 31, 2020, as part of a pre-authorized debit agreement with the CRA through our business account.

As soon as this program was was announced I felt excited because we would have the opportunity to keep paying some of our staff for a few more weeks thanks to the deferral. I logged on to our CRA My Business Account and went to cancel our pre-authorized debit and saw this message.

Because the announcement was made by the government only 4 days before the payment deadline (March 31) there would be no way for us to cancel the payment online.

I then attempted to call CRA through their phone line at 1-800-959-5525. For my first call, made at 1:38 PM on Friday March 27 (only a few minutes after the announcement) I was on hold for 2 hours and 31 minutes before the call disconnected. After calling back the line was busy and disconnected automatically. Finally, at 6:30 PM, a call connected and I was informed by a robot voice that the office was closed and I would have to call back on Monday.

On Monday, March 30, 2020 I called again from my phone several times but the call would not go through (Call Failed).

Finally, I asked my girlfriend to try calling as well through her phone. She was able to get on hold. After waiting for over 1 and a half hours (see call log below) someone answered. Very rudely, this person, a woman, asked what I wanted. Obviously I do not fault her directly, she is probably dealing with the same stressors as the rest of us. I told her that we had a Pre Authorized Debit payment that was scheduled for tomorrow to the Government for GST and that I wanted to cancel it. She then told me that it would require 10 business days’ notice. Yes. 10 business days. 5 days longer than what was listed on the website. I asked her what I could do and she offered no options. I then asked her if I would be charged a fee from the government if the payment from the bank bounced, she did not know. I told her I would try calling my bank. Without saying goodbye she hung up.

As an aside: There must be a majority of businesses that have a pre-authorized payments scheduled for March 31 as it is the end of Q1 and most small businesses remit GST quarterly, so this cannot possibly only affect me. It seems as though this program (along with several others) are merely an illusion or a fabrication that most businesses could never hope to actually access. It scares me that government could be so obviously disingenuous or incompetent so as not to be able to execute as simple of a function as cancelling a payment.

I am now on hold with my bank (RBC) to try to cancel the payment from their side.

Like many businesses, we are struggling and our sales have completely stopped since lockdowns began over two weeks ago.

Update: After speaking with RBC for several hours, they were unable to help me cancel the payment. Finally, a representative recommended that I try to empty the account and take the hit of a $50 NSF in order to have the payment not come out of the account. I did this, but somehow the payment still came out and I now have a negative balance in the account. I will update you soon.

This entire process has been beyond frustrating. While trying to run my business and keep it moving forward, I am trying to apply for these government programs so that we do not fall behind and lose out on funds that have become available. It seems that the government is creating distractions to pull business owners’ attention away from the fact that they have forced us to shut down because they were unprepared to respond to this pandemic with the equipment and medical supplies and medicine that was needed. Instead of spending $200 Billion on business “relief” programs that no one can access, why not spend it on medical masks, vaccine research, health care workers, and ventilators?

March 2020 – Applying AI: Transforming Finance, Investing, and Entrepreneurship

It was a matter of need.

In 2014 I was working as an engineer in Hanna, Alberta, a town of about 2600 people at a Power Generating Station. I’m a city-boy and my girlfriend, at the time, lived in Edmonton. My family and friends were spread out between Calgary and Edmonton, each about a two-and-a-half-hour drive from Hanna. I’d drive out every weekend to see my girlfriend, or my parents, or my friends. After a few months, I became mentally and physically exhausted from all the driving. I was falling behind with my work and my mental health was deteriorating. One day, after being on the road for a gruelling multi-hour road trip, I decided to calculate how much time I was spending driving on the road. It was more than 20 hours per week! That’s basically 50% of a full-time job, fully 12% of all the time one has in a week, doing nothing but staring at an open road.

I wasn’t able to make productive use of my time because I had to focus on driving safely (as we all do), and by the time I arrived at my destination, I was exhausted from focusing for so long. Of course, as an Electrical Engineer, I’ve always been fascinated by technology, particularly autonomous and electric vehicles. I would listen to podcasts about business, books about Elon Musk, and read articles about Tesla, and how companies like Waymo would create fully autonomous vehicles that would reinvent how people travel. I knew I needed to be part of that revolution.

Because I was an electrical engineer, working at a Power Plant, I knew how energy was generated, transmitted and stored, and I knew what it cost and how simple the electric motor was compared to a gasoline engine. I wanted an autonomous car, and an electric car… I wanted a Tesla. But I had no idea how I could ever afford one. Even making over $100,000 per year as a 23-year-old engineer, a $150,000 car was a big ask.

I can’t say it was an epiphany, but, one day, I did have a big realization. I realized that my time was worth about $50 an hour towards my income and even more for the company I was working for. If I was spending 20 hours a week on the highway, that equated to over $1000 a week in lost productivity. I knew there were other people who had this problem, especially with commute times perpetually on the rise in North America. There was a way to solve my driving problem, recover my lost time, get a Tesla, and in doing so, help thousands (potentially millions) of others who had the same problem. All I had to do was start a company.

The seed of InOrbis was born. The model was simple, ferry weary business travellers between cities in autonomous electric vehicles. It took me two more years to save the money to purchase our first vehicle, a Tesla Model X. The business model changed a lot over that time. Through countless customer interviews, an incubator, investor pitches and several dozen grant applications, InOrbis Intercity operated our first trip, driving a lawyer and his colleagues from a major firm in Calgary on a same-day round trip to Edmonton in May of 2017.

Why electric? Because of economics. An electric car can cost as little as $0.15 per km to operate (if you drive a lot of kilometres), thanks to low energy costs and almost non-existent maintenance costs. Why autonomous? Because 75% of the cost of a ridesharing service is paying the drivers. Of course, sustainability and safety are key aspects as well, but they are secondary to making a business that can be profitable.

In 2020, we have nearly 20 active owner-operated vehicles in Alberta and are building our business with our core group of clients, namely professionals (doctors, lawyers, judges and, consultants), as well as with eco-tourists and everyday commuters. With our revenue nearly doubling year-over-year, and our operations currently limited to one province, the growth and traction we have seen is inspiring. We are incredibly excited for the opportunity to expand into provinces that are even more EV-friendly like Ontario and BC and into states in the US that are even more business-friendly.

I will continue to grow InOrbis until the vision is realized, when business travel is no-longer a time- wasting, exhausting slog and getting from A to B, 300 kilometres apart, is as easy as stepping onto an elevator. Until then, we’ve got a lot of work to do.

The Story of InOrbis – Applying AI

It was a matter of need.

In 2014 I was working as an engineer in Hanna, Alberta, a town of about 2600 people at a Power Generating Station. I’m a city-boy and my girlfriend, at the time, lived in Edmonton. My family and friends were spread out between Calgary and Edmonton, each about a two-and-a-half-hour drive from Hanna. I’d drive out every weekend to see my girlfriend, or my parents, or my friends. After a few months, I became mentally and physically exhausted from all the driving. I was falling behind with my work and my mental health was deteriorating. One day, after being on the road for a gruelling multi-hour road trip, I decided to calculate how much time I was spending driving on the road. It was more than 20 hours per week! That’s basically 50% of a full-time job, fully 12% of all the time one has in a week, doing nothing but staring at an open road.

I wasn’t able to make productive use of my time because I had to focus on driving safely (as we all do), and by the time I arrived at my destination, I was exhausted from focusing for so long. Of course, as an Electrical Engineer, I’ve always been fascinated by technology, particularly autonomous and electric vehicles. I would listen to podcasts about business, books about Elon Musk, and read articles about Tesla, and how companies like Waymo would create fully autonomous vehicles that would reinvent how people travel. I knew I needed to be part of that revolution.

Because I was an electrical engineer, working at a Power Plant, I knew how energy was generated, transmitted and stored, and I knew what it cost and how simple the electric motor was compared to a gasoline engine. I wanted an autonomous car, and an electric car… I wanted a Tesla. But I had no idea how I could ever afford one. Even making over $100,000 per year as a 23-year-old engineer, a $150,000 car was a big ask.

I can’t say it was an epiphany, but, one day, I did have a big realization. I realized that my time was worth about $50 an hour towards my income and even more for the company I was working for. If I was spending 20 hours a week on the highway, that equated to over $1000 a week in lost productivity. I knew there were other people who had this problem, especially with commute times perpetually on the rise in North America. There was a way to solve my driving problem, recover my lost time, get a Tesla, and in doing so, help thousands (potentially millions) of others who had the same problem. All I had to do was start a company.

The seed of InOrbis was born. The model was simple, ferry weary business travellers between cities in autonomous electric vehicles. It took me two more years to save the money to purchase our first vehicle, a Tesla Model X. The business model changed a lot over that time. Through countless customer interviews, an incubator, investor pitches and several dozen grant applications, InOrbis Intercity operated our first trip, driving a lawyer and his colleagues from a major firm in Calgary on a same-day round trip to Edmonton in May of 2017.

Why electric? Because of economics. An electric car can cost as little as $0.15 per km to operate (if you drive a lot of kilometres), thanks to low energy costs and almost non-existent maintenance costs. Why autonomous? Because 75% of the cost of a ridesharing service is paying the drivers. Of course, sustainability and safety are key aspects as well, but they are secondary to making a business that can be profitable.

In 2020, we have nearly 20 active owner-operated vehicles in Alberta and are building our business with our core group of clients, namely professionals (doctors, lawyers, judges and, consultants), as well as with eco-tourists and everyday commuters. With our revenue nearly doubling year-over-year, and our operations currently limited to one province, the growth and traction we have seen is inspiring. We are incredibly excited for the opportunity to expand into provinces that are even more EV-friendly like Ontario and BC and into states in the US that are even more business-friendly.

I will continue to grow InOrbis until the vision is realized, when business travel is no-longer a time- wasting, exhausting slog and getting from A to B, 300 kilometres apart, is as easy as stepping onto an elevator. Until then, we’ve got a lot of work to do.

Repost: What to do about COVID-19? – Applying AI

It’s about your psychological health and survival.

As the internet gets inundated with graphs and viral misinformation about COVID-19, and the many ramifications, it’s easy to go down a rabbit hole of fear and start imagining a veritable apocalypse.

(It’s also just as easy to err in the other direction and erroneously say that everyone is just over-reacting to a flu bug).

But what’s hard to do in these times of high uncertainty and high anxiety, when the ground is shifting under us and very little is the same as it was two weeks ago, is to manage your internal state.

So here is a Five Step Action Plan to help you gain some equanimity during this unprecedented time:

Step One: Prepare, don’t panic.

There is a big difference between preparingand panicking.

If you’re preparing, you’re logically evaluating a situation, taking the necessary steps keep yourself safe, and monitoring for any major developments.

If you’re panicking, you’re probably not prepared, and likely won’t be able to prepare intelligently either. You become a liability to yourself and others.

So avoid the anxiety of feeling unprepared by actually preparing. Do your research, make a list of what you need, obtain those items, and create protocols to keep your home and surroundings (including workplace if applicable) a safe zone at all times.

Once you have this set up, and you can do it in half a day or less, you can move on to the next step:

Step Two: Operate in reality, not anxiety.

Anxiety is an exercise in future projection, according to the leading neuroscientist Joseph LeDoux.

It takes place in a different part of the brain than fear.

Fear is an instant response to a present danger.

Anxiety is an exercise of the imagination.

And some people are imagining the worst.

So here’s a fact that may help those who have major concerns about the economy, which is likely just about everyone.

During the Great Depression, there was no uptick in deaths. In fact, mortality rates actually improved. So people survived financial devastation. And we will survive the economic consequences of this.

However, there was one distinct category during the Great Depression where there were more deaths: Suicide.

Some people thought they lost everything when what they really lost was their savings, their investments, their businesses. But if you have your self, the people you love, and you all manage to stay healthy through this, you have everything.

The rest, while painful, can be rebuilt, just as it was built from nothing in the first place.

If life gets very tough and we have to struggle, it will make us stronger, it will make us more grateful, and we will bounce back.

The number one priority is to care for your health and your immunity, and adding unnecessary stress hurts both of those.

So do the inner work to have inner calm during all this.

Remember:

You cannot control every event in the outer world, but you can control your reactions to them.

This is an equation from former Brian Kight…

Event + Reaction = Outcome

One half of that equation is fixed. Now is the time to dial in the other half of it, work on your reactivity, and balance your inner world.

This leads us to:

Step Three: Create a self-care regime

While we are disconnecting from others during this time, the social implications of which are going to be staggering, what is going to come up is a lot of the feelings that we medicate through work, sex, the gym, socializing, and generally keeping busy.

The biggest challenge for many is to sit alone with themselves; for others, it’s to sit cooped up with their families pressing the buttons they haven’t worked to remove yet.

So your main job is to really take care of yourself, inside and out.

Make yourself a schedule and stick to it.

Don’t have a morning routine? Time to start one.

Don’t eat healthy meals and supplementation? Time to be the healthiest you’ve ever been.

Don’t have a meditation practice? Time to find one.

Don’t exercise? Find a great resource online and do it daily. And get outside or get fresh air while still social distancing.

Feeling depressed, alone, or anxious? Feel deeply into it, notice it, observe it, and get curious about it. When have you felt it before? What’s it really about? Our neuroses will attach to this new situation. It is a great time to feel in order to heal.

News getting you worked up? Download Freedom or a similar app, and only give yourself access to news and/or social media sites for two small windows of time during the day.

The real goal here is not to sink into malaise or lethargy, but to leap into motivation.

So many people I talk to say that their job gets in the way of their passions. Well, here’s your chance. Many of you can use this time to work on living those passions.

And I can guarantee one other thing: if you do not use this time productively, but instead fritter it away compulsively checking Twitter and the news, you will deeply regret having wasted a precious opportunity.

And before a few of you email saying that’s not possible for you because of this or that reason, read the next step.

Step Four: Adapt and Flourish

I’ve seen two responses to the shift we are all experiencing.

Response One: All these things are gone now, I’ll have to live without them and wait it out.

Response Two: All these things are gone now, I’ll do other things instead.

The first response is fixed mindset, the second is growth mindset.

The world we once knew is gone for now. We are in a new reality.

And to survive it, we must use the trait that has enabled our species to survive for so long: adaptability.

If your business model is suffering, pivot to something that people need now. If you lost your job, look at where the needs are in society right now. Now’s the time to get proactive and start a new life. Amazon, for example, just announced it was hiring 100,000 people.

If you’re upset that you have to put your social plans on hold, then figure out how to socialize in this new world. My in-person game night became a fun game night using multiple-player app-games with everyone on video conference.

Can’t go on dates? People are lonely. Now’s the time to build a deep connection with someone new, and just treat it like a long-distance relationship.

Switch from the fear and scarcity brain to the problem-solving and abundance brain.

When your back is against the wall, it’s a good time to find a new door.

But always remember…

Step Five: Service

A lot of people are suffering, and more will likely suffer and worse. Part of this opportunity for you is service. A chance to give back.

If you have the economic means, see if there’s a helpful initiative you can donate to for your community, or the elderly and other high-risk populations. Is there anything materially or physically you can do? Spend a day thinking of ways to be of service, then add that to your self-care regime.

After all, one of the best ways to get out of your own emotional lows is to help others with their lows. Love, compassion, and community is the best medicine. It lasts longer than laughter.

P.S. I’ll close this with a poem that went viral, in case you haven’t seen it. As with all things viral, the attribution may not be correct:

And the people stayed home. And read books, and listened, and rested, and exercised, and made art, and played games, and learned new ways of being, and were still. And listened more deeply. Some meditated, some prayed, some danced. Some met their shadows. And the people began to think differently.

And the people healed. And, in the absence of people living in ignorant, dangerous, mindless, and heartless ways, the earth began to heal.

And when the danger passed, and the people joined together again, they grieved their losses, and made new choices, and dreamed new images, and created new ways to live and heal the earth fully, as they had been healed.

–Kitty O’Meara

February 2019 – Applying AI: Transforming Finance, Investing, and Entrepreneurship

Introduction

I often think of AI as something separate from traditional computer programming, something transcendent. However, most of the advances in modern AI are not the result of revolutionary new concepts or fields of study but rather the application of previously developed algorithms to significantly more powerful hardware and massive datasets.

Hannah Fry’s take on the world of AI covers topics ranging from justice to autonomous vehicles, crime, art and even to medicine. While the author is an expert in the field, she does a great job distilling the topics down to a level understandable by a layperson, but also keeps it interesting for someone with more background in programming and AI.

My favourite quote from the first part of the book comes on page 8, where Hannah succinctly describes the essence of what an algorithm is in only one sentence:

An algorithm is simply a series of logical instructions that show, from start to finish, how to accomplish a task.

Fry, Hannah. Hello World: Being Human in the Age of Algorithms (p. 8). W. W. Norton & Company. Kindle Edition

Once you read it, it seems obvious, but trying to describe to a first-year computer science student what an algorithm is can be a challenging task. The author manages this well. Despite the complexity and depth of the subject matter, Fry is able to bring context and relevance to a broad array of topics. The remainder of my review will speak to some of the book’s many sections and how someone with a business-facing view into the topics sees them.

Data

This section covers some of the unknown giants in data-science including Peter Thiel’s Palantir. The section also touches on some very public examples where analytics has played a negative role – Cambridge Analytica’s use of private user data during the 2016 Presidential Elections.

The story here is about data brokers. Data brokers are companies who buy and collect user data and personal information and then resell it or share it for profit. A surprising fact is that some of these databases contain records of everything that you’ve ever done from religious affiliations to credit-card usage. These companies seem to know everything about just about everyone. It turns out that it is relatively simple to make inferences about a person based on their online habits.

The chapter converges to one of the major stories of 2018, the Cambridge Analytica scandal. But it begins by discussing the five personality traits that psychologists have used to quantify individuals’ personalities since the 1980s: openness to experience, conscientiousness, extraversion, agreeableness and neuroticism. By pulling data from users’ Facebook feeds, Cambridge Analytica was able to create detailed personality profiles to deliver emotionally charged and effective political messages.

Perhaps the most interesting fact though, is how small of an impact this type of manipulation actually has. The largest change reported was from 11 clicks in 1000 to 16 clicks in 1000 (less than 1 percent). But even this small effect, spread over a population of millions can cause dramatic changes to the outcome of, say, an election.

That’s the end of part 1 of this review. In Part 2, I’ll touch on some of the other sections of the book including Criminal Justice and Medicine.